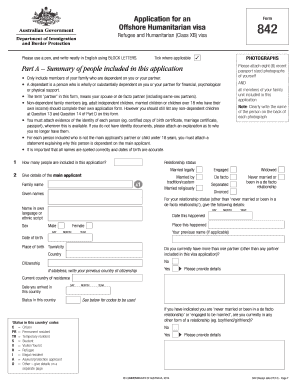

AU Form 842 2015-2024 free printable template

Show details

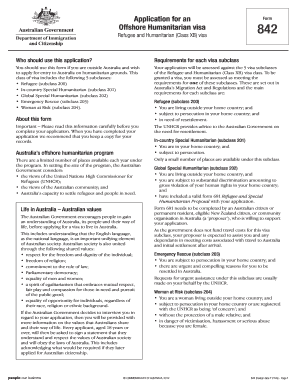

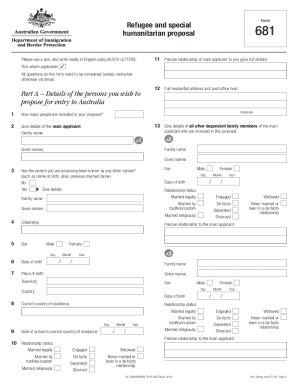

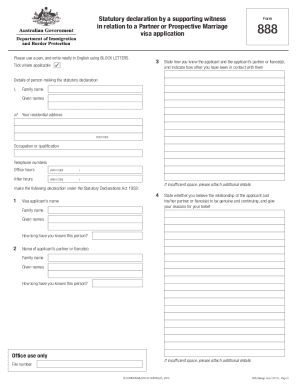

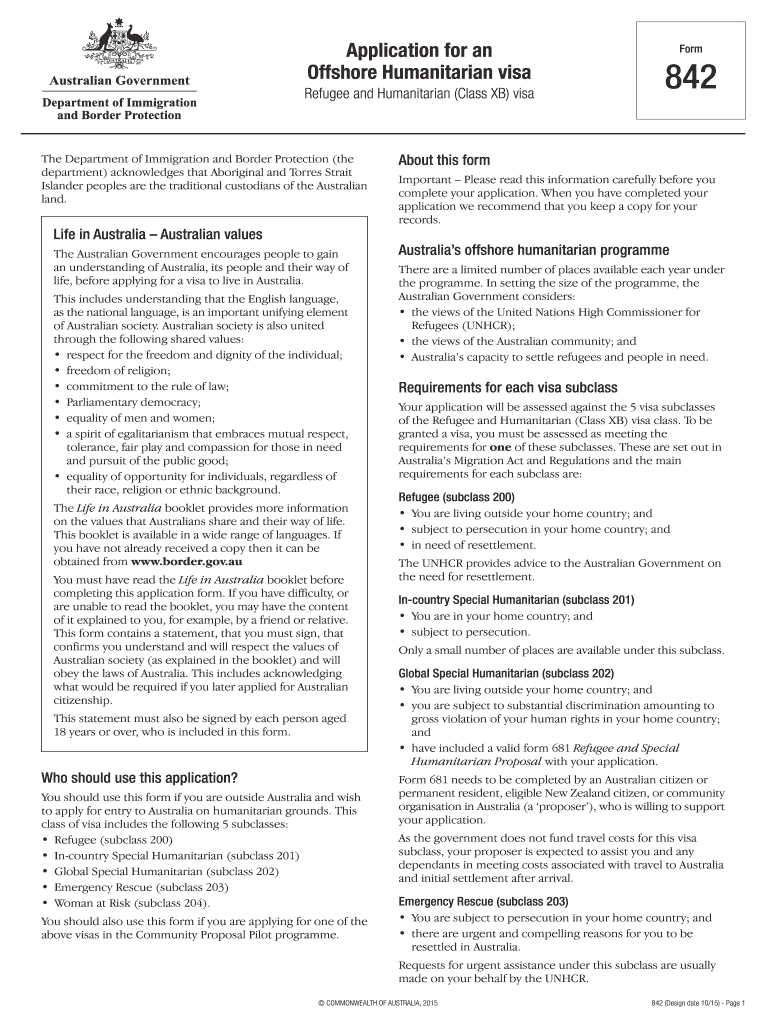

There is no charge for lodging or processing form 681. Note APOs under the Community Proposal Pilot must complete form 1417 Proposal for refugee and special humanitarian entrants by Approved Proposing Organisation and lodge both form 1417 and this form form 842 together. Non-dependent family members eg. married children or children over 18 who are independent should complete their own form 842 if they wish to be considered for entry to Australia Note Under the split family provisions...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your fill online 842 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fill online 842 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 842 form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 842. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

AU Form 842 Form Versions

Version

Form Popularity

Fillable & printabley

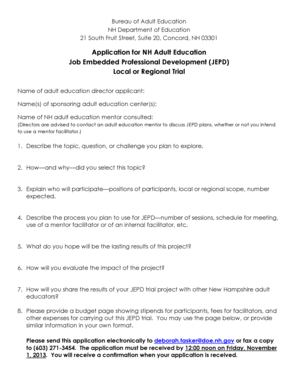

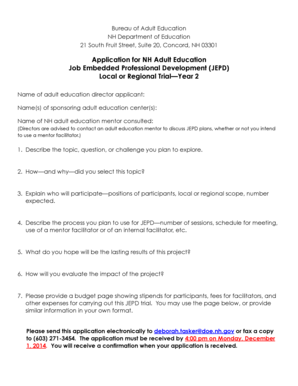

How to fill out fill online 842 form

How to fill out 842 form:

01

Start by gathering all the necessary documents and information required for the form.

02

Carefully read the instructions provided with the form to understand the requirements and guidelines.

03

Begin filling out the form by entering your personal information accurately in the designated sections.

04

Provide the required details regarding your income, expenses, assets, and liabilities as instructed.

05

Be sure to double-check all the information entered to ensure accuracy and completeness.

06

Attach any supporting documents or additional information that may be required.

07

Review the completed form and make any necessary corrections or revisions before submitting.

Who needs 842 form:

01

Individuals who are applying for a specific type of financial assistance.

02

Businesses or organizations that are requesting funding or grants.

03

Certain government agencies or institutions that require specific financial information for assessment or evaluation purposes.

Fill 842 form australia : Try Risk Free

People Also Ask about 842 form

Who should fill Form 842?

Can I submit Form 842 online?

What is Form 842 for?

How to apply Form 842?

How to apply for Australian humanitarian visa for Afghanistan?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 842 form?

The 842 form is an Internal Revenue Service (IRS) form used to classify workers as independent contractors or employees. This form is used to determine whether or not the worker should receive a W-2 or 1099 form at the end of the year. The 842 form is also used to identify and record payments made by employers to independent contractors.

Who is required to file 842 form?

The 842 form must be filed by any employer who is subject to the Federal Insurance Contributions Act (FICA) tax and who pays wages to an employee in excess of $200 in a calendar quarter. This includes most employers who are subject to the FICA tax, including those who are self-employed, corporations, partnerships, and limited liability companies.

How to fill out 842 form?

1. On the first page of the 842 form, enter your name and address in the upper left-hand corner.

2. On the second page, enter the date that you are filing the 842 form in the lower left-hand corner.

3. On the third page, provide information about your employer, including their name and address, and the contact information of the person to contact with any questions.

4. On the fourth page, enter any deductions or credits that you need to claim, including the type and amount of each deduction or credit.

5. On the fifth page, provide information about your income, including your wages, salaries, and other forms of income.

6. On the sixth page, enter any deductions or credits that you need to claim, including the type and amount of each deduction or credit.

7. On the seventh page, enter your filing status and other information about your tax situation.

8. On the eighth page, review and sign the form. Make sure to enter the date of your signature in the bottom right-hand corner.

9. Attach any additional forms or documents that are required and mail the 842 form to the address provided.

What is the purpose of 842 form?

The 842 form is an Internal Revenue Service (IRS) form used to report federal tax withholding on wages. It is used to report the total amount of federal income tax withheld from an employee's wages for the year. It is also used to report the total wages paid to the employee and the total tax withheld.

What information must be reported on 842 form?

The 842 form requires businesses to report information about their workers’ wages, such as the employee’s name, address, Social Security number, hours worked, and wages earned. It also requires employers to report the type of work performed, such as whether it was regular or overtime, and the number of hours worked in each category. Additionally, employers must report any deductions from the employee’s wages, such as taxes, insurance, and other benefits.

When is the deadline to file 842 form in 2023?

The deadline to file Form 842 in 2023 is April 15, 2024.

What is the penalty for the late filing of 842 form?

The penalty for late filing of Form 842 is $10 per day, up to a maximum of $5,000. The penalty is assessed from the due date of the return until it is filed.

How can I manage my 842 form directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your form 842 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an electronic signature for the form 842 fill online in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your فورم 842 استراليا 2023 in seconds.

How do I fill out the 842 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign 842 form 2023 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your fill online 842 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 842 Fill Online is not the form you're looking for?Search for another form here.

Keywords relevant to فورم 842 استرالیا 2023 form

Related to 842form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.